Welcome to part three of our course! Below, you’ll find the contents of the video above in text form. We’re releasing the course one lesson a week, every Wednesday over twelve weeks. Enjoy!

Building upon our exploration of the necessity of money, let’s start to explore the core question: What is money?

Go grab a piece of candy. If you don’t have one, grab some small object near you and pretend it is a piece of candy. Place it in front of you.

Who would be willing to trade their candy for a US$1 bill? Raise your hand if so.

Now, keep your hands up if you would still be willing to trade your candy for a $1 monopoly bill instead of your piece of candy.

Why or why not?

What makes one bill so desirable and another one basically valueless?

Do you ever wonder what makes money… well, money? Most of us know how to use it, but not many of us understand where it comes from or how it works.

The most understood function of money is that it is a way to exchange goods and services. It represents the value of these items in a form that can be easily traded. This value goes beyond physical properties, like the paper it's printed on.

Take a moment to reflect on the quotes here.

Money can take many different forms, such as paper notes, metal coins, and electronic payments. Governments or other authorities typically issue and control money, but money is so much more than just a physical or digital medium of exchange; it’s like a universal language that allows us to trade with people all around the world, even if we don’t speak the same language or have the same culture. For example, you can be on the other side of the world and still “speak” money by placing a product on the counter and exchanging it for the local currency or using a credit card. But if you don’t have your card or the right currency, you can’t exchange value.

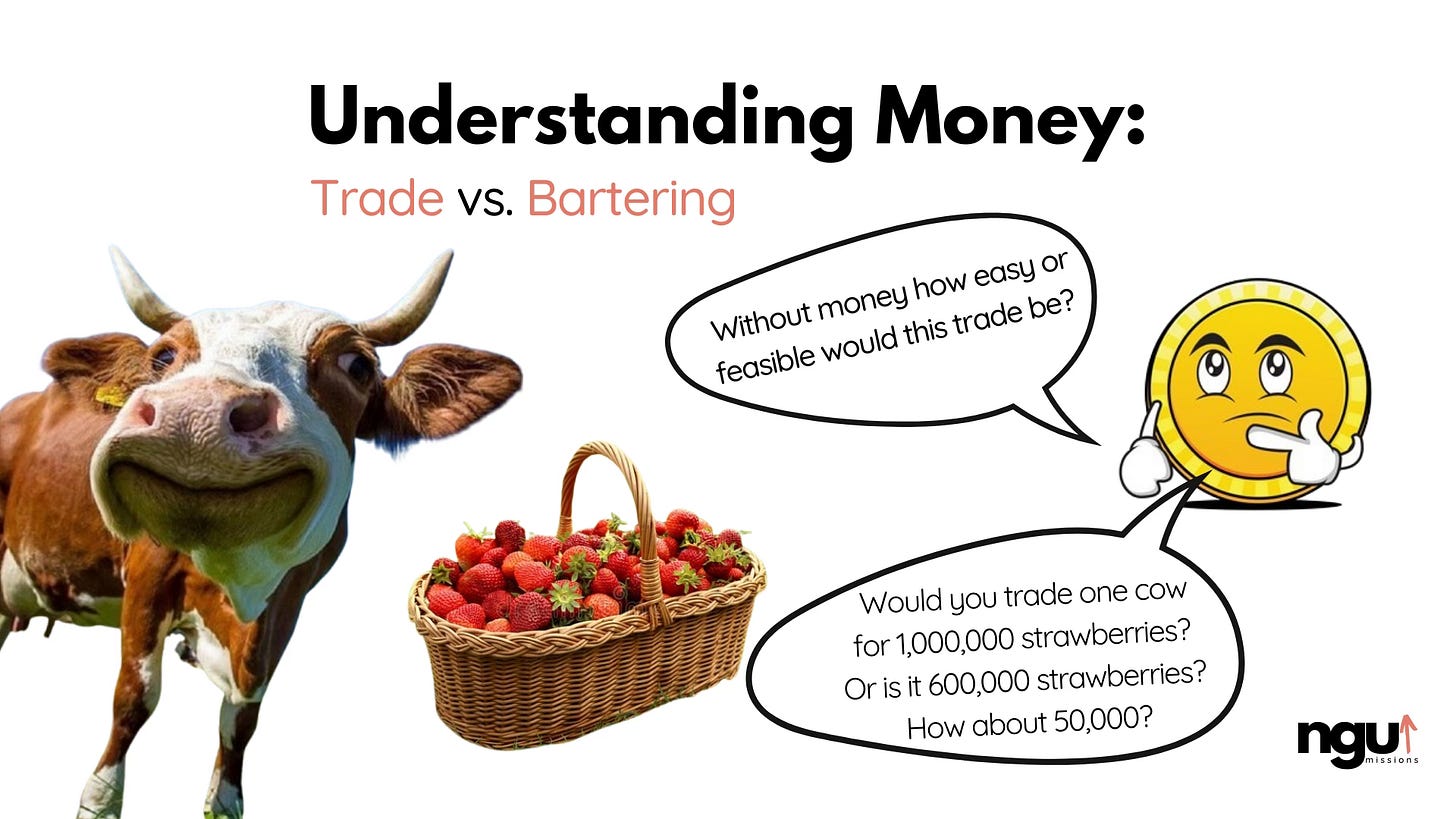

Money allows us to make exchanges without having to rely on bartering, that is trading items or services directly, which requires finding someone who wants what we have to offer.

As French economist Jean-Baptiste Say pointed out, “Money is but the agent of the transfer of values.” In other words, money itself doesn’t have the power to satisfy human wants; it is a tool to help us to trade one thing for another.

There are many different types of transactions, ranging from simple exchanges (such as buying a sandwich at a deli or a book at a bookstore) to more complex financial transactions (such as buying a house or investing in stocks or bonds).

“Money is but the agent of the transfer of values.” —Jean-Baptiste Say

A summarized teaching from Pope Leo XII in his encyclical Rerum Novarum: the buying and selling of goods, which is facilitated by money, is a natural activity of man when conducted with justice. And how does that buying and selling happen?

In summary, most people understand that money facilitates trade, as it’s universally accepted as final payment. And why? Because it has value beyond its physical properties. Later, we’ll learn where this value comes from.

Note that this course does not delve into what “buying and selling with justice” means in Pope Leo XIII’s teaching. Rerum Novarum provides principles for how a just society produces, distributes, and consumes goods and services. For example:

Fair agreements: Emphasizing the importance of just contracts between worker and employer, respecting the dignity of both parties.

Use property responsibly: Highlighting that owning things comes with a duty to help others, and that employees should respect employers’ property.

This course, however, addresses, “What is money?” and then, “What is a good money system?” These are seemingly small parts of a vast economy, but because money is so often used, the quality of our money impacts how well we can live the just Christian economy Pope Leo XIII calls us to.

In the next video, we’ll look in more detail at the functions of money.

Test your understanding

True or False: The value of money is solely based on its physical properties, like the paper it’s printed on.

Fill in the Blank: The video states that money allows us to make exchanges without relying on ___________, which is trading goods directly for other goods.

Multiple Choice: According to the video, what is the most known function of money?

To accumulate wealth for its own sake.

To facilitate trade by acting as a medium of exchange.

To control governments and economies.

To replace the need for physical goods.

Answers here.

Links:

Pope Leo XIII: Rerum Novarum (summarized teaching in paragraph 22)

Have feedback to improve this part of the course? Submit it anonymously here.

Read this post in Spanish here.

The next part of the course will be released on Wednesday, April 2, 2025.

Share this post